In order to access your merchant application, please reach out to your Customer Success Manager.

At that time, the signer will receive the application via email from Cardpointe (Fiserv). The subject will be "Your CardPointe Application is Ready to Sign". The signer should then select the "Sign My Application" within the message to create access to the merchant agreement and view and sign it.

Complete the reCAPTCHA and select Begin Your Application.

1. Business Details

- Business Legal Name: Enter the Legal/IRS Name of your organization.

- DBA Name: “Doing Business As” name, aka the public name of your organization. This will be the name located on the cardholder’s credit card statements.

- Business Phone: Enter the general contact phone number for your organization.

- Website: Enter your organization’s main website URL.

- Business Address: Begin entering your organization’s *physical* address, and it should auto-populate to be selected below. NOTE: A P.O. Box cannot be accepted as the Business Address.

1. Business Details (Continued)

- Years In Business: Select from the available options.

- Type Of Ownership: Select from the available options.

- Tax ID: Enter your organization’s EIN, and double-check that it’s accurate.

- Industry: Select from the available options. Non-profits are 8398 - Charitable And Social Service Organizations

.png)

Business Owner Information

All of the following fields are required to be provided by your organization's financial signer in order to move forward with the application process.

- Enter your First and Last Name.

- % of Ownership: 0%.

- You do not need to be an “Owner” of the organization to complete the application.

- Recommended to enter 0% as a non-profit

- Enter your Date of Birth

- Signer needs to be at least 18 years old.

- Enter the Last 4 of your SSN.

- Enter your Email Address.

- Email needs to be connected to the signer.

- You do *not* need to select “I give my Personal Guarantee”.

- Residence Address: Use the look-up tool to select your *residence* address.

Once you submit your merchant account application, the information you provide will be checked against the list of Specially Designated Nationals (SDNs) and similar lists maintained by the U.S. government.

**Providing your personal information will not result in a hard inquiry on your credit report, nor will it affect your credit score.

- Due to federal banking laws, the Social Security Number is a required field.

- The application will only ask for the last 4 digits of the SSN, unless the system is not able to verify your contact info. If the system is unable to verify your identity, you may receive the following message prompting you to enter in your full SSN:

- The application will only ask for the last 4 digits of the SSN, unless the system is not able to verify your contact info. If the system is unable to verify your identity, you may receive the following message prompting you to enter in your full SSN:

- The Bank Secrecy Act (BSA), also known as the Currency and Foreign Transactions Reporting Act, is legislation passed by the United States Congress in 1970 that requires U.S. financial institutions to collaborate with the U.S. government in cases of suspected money laundering and fraud. The Financial Crimes Enforcement Network (FinCEN) has implemented new rules around Bank’s Due Diligence under the Bank Secrecy Act (BSA). Over the years, BSA has been strengthened through subsequent anti-money laundering (AML) laws. This includes parts of USA PATRIOT Act compliance, which focus on money laundering in the form of terrorist financing.

2. Banking & Processing Information

This information entered into this section will be used to set up direct deposit with your bank. It’s very important that you review this section for accuracy. If the incorrect routing or account numbers are entered, this could cause delays in receiving funds.

- Enter the Bank Name.

- Choose the Account Type (should be a Checking account).

- Enter the Routing Number.

- Enter the Account Number.

Debits will appear from the ACH ID G592126793, and your direct deposits will appear as "MERCHANT BANKCD DEPOSIT 496-----------" where the numerical figure starting with "496" is your merchant ID.

Goods & Services

Enter in the Average Annual Card Volume and the Average Transaction (Donation) Amount you expect to receive.

Mode of Transaction

- This should be set to 100% Online.

- Third Party Provider: No

- Product/Service Delivery Windows: Yes

3. Equipment

- No action is required on this step. CardPointe’s Gateway will be selected by default. Select “Ok. Looks great, let’s move on!”

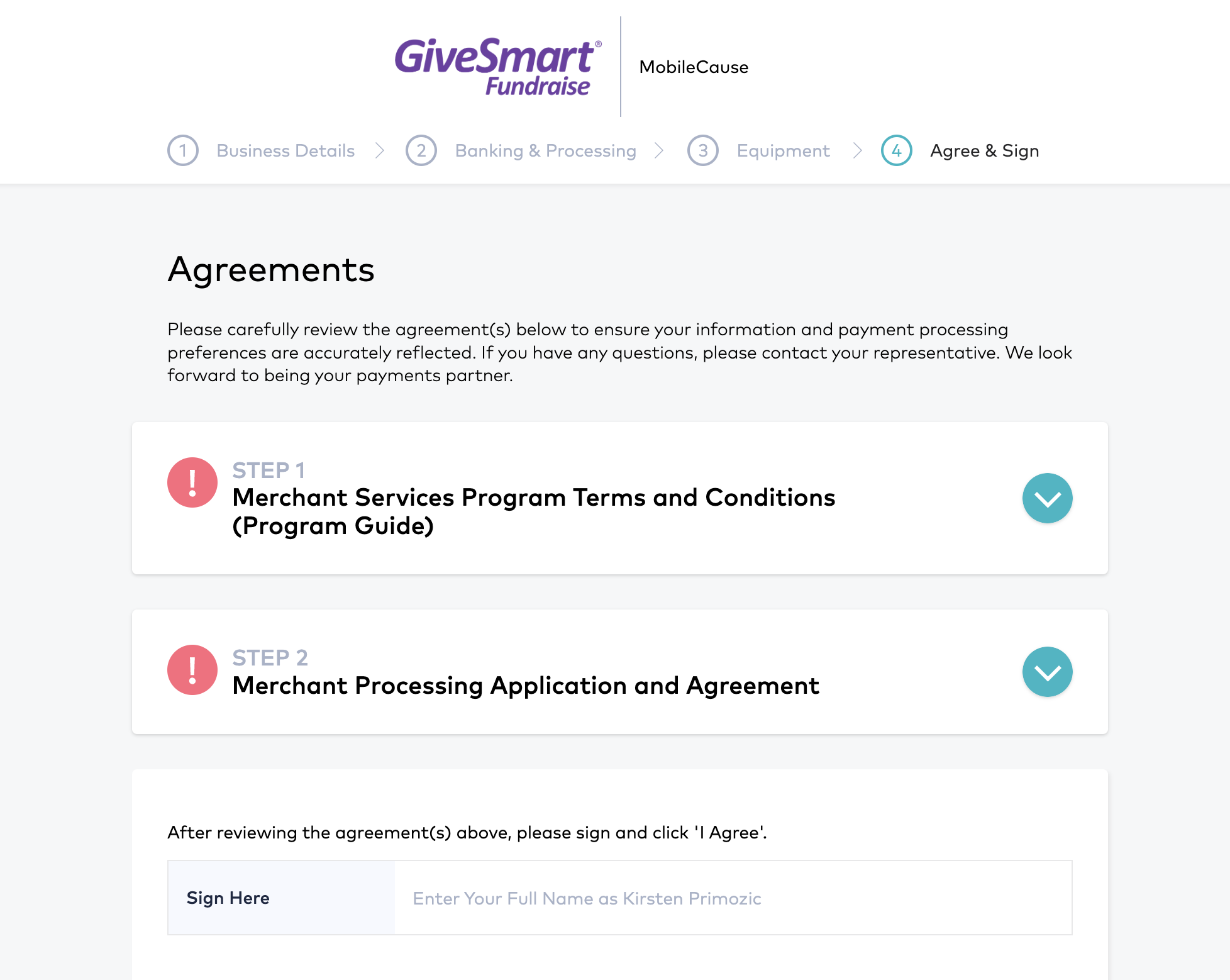

4. Agree & Sign - Step 1

Merchant Services Program Terms and Conditions (Program Guide)

- To proceed, scroll all the way to the bottom of the document

- Check the "I have read and agree to the Merchant Services Program Terms and Conditions (Program Guide)"

- Select Complete Step 1

4. Agree & Sign - Step 2

Merchant Processing Application and Agreement

- The fees should reflect your agreed-upon processing fees reflected in your GiveSmart Fundraise contract, so make sure to verify that the percentage is correct. (screenshot below)

- There are no transaction fees, monthly fees, or cancellation fees because of our special agreement with CardConnect.

- After reviewing, scroll to the bottom of the document, enter your initials, and check the I have read and agree to the Merchant Processing Application and Agreement box, then select Complete Step 2.

4. Agree & Sign - Step 2 (Continued)

Merchant Processing Application and Agreement

- In Sign Here, you will need to type in the name that you entered in the initial application.

- Click I Agree to digitally sign and agree to the request.

Next Steps- Application Processing

After digitally signing, the application will be sent to CardConnect’s Underwriting team for review. If no additional information is required, it can take 5-7 business days for the merchant account to be live. Once live, the contact on the application will receive an email from Support confirming that your Merchant Account is Live.